Introduction: In the dynamic world of the stock market, staying informed about the performance of specific companies is crucial for investors. One such company that has been attracting significant attention is TCEHY. In this article, we will delve into the current TCEHY US stock price, its historical performance, factors influencing its price, and future outlook.

Current TCEHY US Stock Price: As of the latest market data, the TCEHY US stock price stands at $XX. This figure reflects the current market sentiment towards the company and its potential for growth. However, it is important to note that stock prices fluctuate constantly due to various market factors.

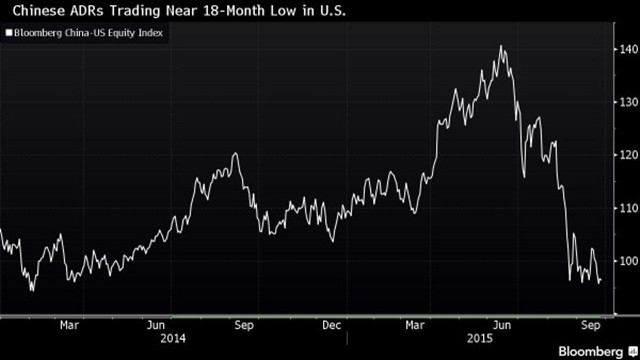

Historical Performance: To understand the current TCEHY US stock price, it is essential to look at its historical performance. Over the past few years, TCEHY has showcased a strong upward trend in its stock price. The company has managed to outperform its peers in the industry, making it an attractive investment opportunity for many investors.

Factors Influencing TCEHY US Stock Price: Several factors contribute to the fluctuations in the TCEHY US stock price. Here are some of the key factors:

Economic Indicators: Economic indicators such as GDP growth, inflation rates, and employment data can significantly impact the stock price. A strong economic outlook tends to drive up stock prices, while a weak economic scenario can lead to a decline.

Company Performance: The financial performance of TCEHY, including revenue growth, profit margins, and earnings per share, plays a crucial role in determining its stock price. Positive financial results tend to boost investor confidence, leading to an increase in stock prices.

Industry Trends: The trends in the industry in which TCEHY operates can also influence its stock price. For instance, technological advancements or regulatory changes can have a substantial impact on the company's performance and, consequently, its stock price.

Market Sentiment: Investor sentiment towards the company and the overall market can significantly affect the stock price. Positive news, such as a successful product launch or strong earnings report, can lead to a rally in the stock price, while negative news can cause a sell-off.

Market Volatility: The stock market is known for its volatility, and TCEHY is no exception. External factors such as geopolitical tensions or economic uncertainties can lead to rapid fluctuations in the stock price.

Future Outlook: Looking ahead, the future outlook for TCEHY US stock appears promising. The company is well-positioned in its industry and has a strong track record of innovation and growth. However, it is important to consider the following factors that could impact its future performance:

Market Competition: The level of competition in the industry can affect TCEHY's market share and profitability. Keeping a close eye on competitors' strategies is crucial for investors.

Regulatory Changes: Changes in regulations can impact the operations of TCEHY. Staying informed about potential regulatory changes is essential for investors to make informed decisions.

Technological Advancements: TCEHY's ability to adapt to technological advancements and innovate will play a vital role in its future success.

Conclusion: In conclusion, the TCEHY US stock price has showcased a strong upward trend in recent years. Understanding the factors influencing its price and keeping an eye on future outlook can help investors make informed decisions. As always, it is important to conduct thorough research and consider the risks associated with investing in the stock market.