In the ever-evolving world of finance, the Dow Jones Industrial Average (DJIA) has long been a benchmark for investors seeking to gauge the health of the U.S. stock market. As we delve into 2024, it's crucial to understand the factors that could influence the DJIA and how investors can position themselves accordingly. This article will provide a comprehensive outlook for the DJIA 2024, analyzing key trends, potential risks, and strategic opportunities.

Historical Performance of the DJIA

To appreciate the future potential of the DJIA, it's essential to consider its historical performance. Over the past decade, the DJIA has experienced significant growth, with several periods of volatility. Understanding these patterns can help us predict future trends and make informed investment decisions.

Key Factors Influencing the DJIA in 2024

Several factors are expected to impact the DJIA in 2024. These include:

- Economic Growth: The pace of economic growth in the U.S. and globally will play a crucial role in determining the DJIA's performance. A strong economy often correlates with higher corporate earnings and, subsequently, higher stock prices.

- Inflation: Inflation remains a key concern for investors and policymakers alike. High inflation can erode purchasing power and negatively impact corporate profits, potentially leading to a decline in the DJIA.

- Interest Rates: The Federal Reserve's monetary policy, particularly interest rates, can significantly influence the DJIA. Higher interest rates can make borrowing more expensive for companies, potentially leading to lower earnings and stock prices.

- Geopolitical Tensions: Global political events, such as trade disputes or conflicts, can create uncertainty and volatility in the stock market, affecting the DJIA.

Potential Risks and Opportunities

While the DJIA has the potential to grow in 2024, investors should be aware of potential risks and opportunities:

- Risks: The main risks include a potential recession, rising inflation, and geopolitical tensions. These factors could lead to a decline in the DJIA.

- Opportunities: Opportunities may arise from sectors that benefit from economic growth, such as technology, healthcare, and consumer discretionary. Additionally, companies with strong fundamentals and a history of resilience may provide attractive investment opportunities.

Case Studies: Companies to Watch

Several companies are poised to perform well in the DJIA in 2024. Here are a few examples:

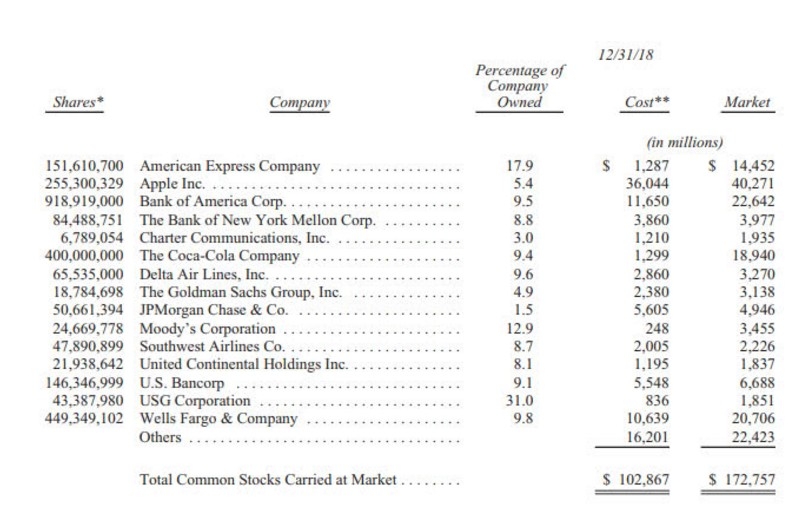

- Apple Inc.: As the world's largest technology company, Apple has a strong presence in the DJIA. Its diverse product portfolio and robust financial performance make it a compelling investment opportunity.

- Johnson & Johnson: This healthcare giant has a long history of innovation and growth. Its strong market position and focus on healthcare solutions make it a potential winner in the DJIA.

- Home Depot Inc.: As the leading home improvement retailer in the U.S., Home Depot has a strong presence in the consumer discretionary sector. Its focus on providing quality products and services to homeowners and do-it-yourselfers positions it well for growth in the DJIA.

Conclusion

The Dow Jones Industrial Average 2024 presents both challenges and opportunities for investors. By understanding the key factors influencing the DJIA and identifying companies with strong fundamentals, investors can position themselves for success in the year ahead. As always, it's crucial to stay informed and make well-informed investment decisions.