In the heart of the financial world, the Stock Exchange USA plays a pivotal role in shaping the economic landscape. Whether you are an experienced investor or a beginner looking to dive into the stock market, understanding the Stock Exchange USA is essential. This article provides a comprehensive guide to help you navigate the complexities of the American stock market.

The Basics of the Stock Exchange USA

The Stock Exchange USA refers to the organized marketplaces where shares of publicly-traded companies are bought and sold. The most well-known exchanges are the New York Stock Exchange (NYSE) and the Nasdaq. These platforms provide a platform for investors to trade stocks, bonds, and other financial instruments.

The New York Stock Exchange (NYSE)

Established in 1792, the NYSE is the oldest and most prestigious stock exchange in the United States. It is located in the financial district of New York City and is home to many of the world's largest companies. The NYSE operates on a floor trading system, where traders and investors gather in a physical location to conduct transactions.

The Nasdaq Stock Market

The Nasdaq Stock Market, on the other hand, operates differently. It is an electronic exchange that lists technology companies and other businesses that meet specific criteria. The Nasdaq has become a popular platform for tech stocks and is known for its innovation and efficiency.

Trading on the Stock Exchange USA

Trading on the Stock Exchange USA involves buying and selling shares of companies. Here are some key concepts to understand:

- Market Orders: These orders are executed immediately at the best available price.

- Limit Orders: These orders are executed at a specific price or better.

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

Understanding Stock Market Indexes

The Stock Exchange USA is home to several stock market indexes that provide a snapshot of the overall market performance. Some of the most well-known indexes include:

- S&P 500: This index tracks the performance of 500 large companies listed on the NYSE, Nasdaq, and Amex.

- Dow Jones Industrial Average (DJIA): This index represents the performance of 30 large companies and is often used as a benchmark for the overall stock market.

- Nasdaq Composite: This index tracks the performance of all companies listed on the Nasdaq.

Investment Strategies for the Stock Exchange USA

When investing in the Stock Exchange USA, it is important to have a well-defined investment strategy. Here are some common strategies:

- Long-term Investing: This strategy involves buying stocks and holding them for the long term, regardless of short-term market fluctuations.

- Dividend Investing: This strategy focuses on investing in companies that pay regular dividends to shareholders.

- Growth Investing: This strategy involves investing in companies with high growth potential, often at a higher valuation.

Case Studies

One notable example of a successful investment in the Stock Exchange USA is Amazon. When it first went public in 1997, its stock price was around

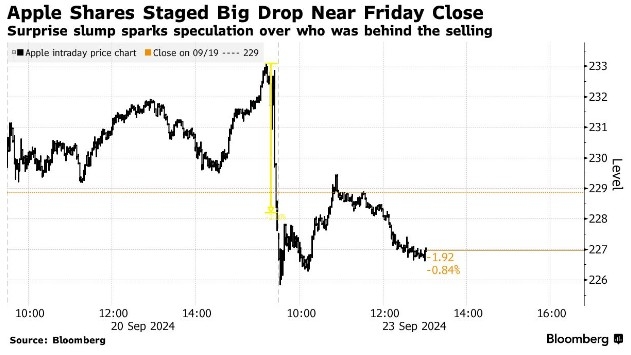

Another example is Apple, which has seen its stock price skyrocket since its initial public offering in 1980. The company's focus on innovation and customer satisfaction has made it a leading player in the technology industry.

Conclusion

Understanding the Stock Exchange USA is crucial for anyone looking to invest in the stock market. By familiarizing yourself with the basics of trading, market indexes, and investment strategies, you can make informed decisions and potentially achieve financial success. Whether you are a seasoned investor or just starting out, the Stock Exchange USA offers a world of opportunities.