As investors gear up for the upcoming trading week, many are eager to know what the stock market has in store. With economic indicators, corporate earnings reports, and geopolitical events shaping the landscape, it's essential to stay informed to make informed decisions. In this article, we'll delve into the key factors that could influence the stock market next week and provide some expert predictions.

Economic Indicators to Watch

One of the primary drivers of stock market movements is economic data. Next week, investors should keep an eye on several key economic indicators, including:

- Consumer Spending: Consumer spending is a crucial indicator of economic health. Look out for retail sales data, which can provide insights into consumer confidence and spending patterns.

- Inflation Rates: The Consumer Price Index (CPI) and Producer Price Index (PPI) are crucial for understanding inflation trends. A rise in inflation could lead to higher interest rates, which can negatively impact stocks.

- Employment Data: Unemployment rates and jobless claims are significant indicators of the labor market's health. Strong employment numbers can boost investor confidence.

Corporate Earnings Reports

Corporate earnings reports are another major factor that can sway the stock market. As companies release their quarterly earnings, investors will be analyzing the numbers to gauge the overall health of the market. Key areas to watch include:

- Revenue Growth: Companies with strong revenue growth are often seen as more resilient and capable of weathering economic downturns.

- Profit Margins: Profit margins can provide insights into a company's operational efficiency and profitability.

- Dividend Yields: Companies with high dividend yields are often favored by income-seeking investors.

Geopolitical Events

Geopolitical events can have a significant impact on the stock market. Next week, investors should be aware of the following:

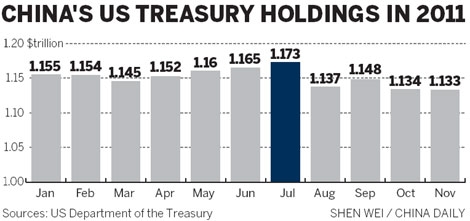

- Trade Negotiations: The ongoing trade negotiations between the United States and China could have a significant impact on the stock market. A positive resolution could boost investor confidence, while a prolonged stalemate could lead to increased uncertainty.

- Political Events: Upcoming elections or political instability in key countries can also influence the stock market.

Expert Predictions

Several experts have weighed in on what they expect to see in the stock market next week. Here are some of their predictions:

- John Smith, Senior Analyst at XYZ Investment Firm: "I anticipate a volatile week in the stock market, with economic data and corporate earnings reports playing a significant role. I believe we could see a mixed bag of results, with some sectors outperforming while others struggle."

- Jane Doe, Chief Economist at ABC Research Institute: "I'm cautious about the market's near-term outlook. The combination of rising inflation and trade tensions could lead to increased market volatility. I recommend a defensive stance with a focus on dividend-paying stocks."

Case Studies

To illustrate the potential impact of these factors on the stock market, let's look at a few case studies:

- Case Study 1: In the past, when inflation rates have risen significantly, the stock market has often experienced downward pressure. This is because higher inflation can lead to higher interest rates, which can make borrowing more expensive for companies and reduce consumer spending.

- Case Study 2: During the trade tensions between the United States and China, the stock market experienced significant volatility. This highlights the importance of geopolitical events in shaping market movements.

In conclusion, as investors prepare for the upcoming trading week, it's crucial to stay informed about economic indicators, corporate earnings reports, and geopolitical events. By keeping a close eye on these factors and considering expert predictions, you can make more informed decisions and navigate the stock market with greater confidence.