The bond market is a crucial component of the financial world, offering investors a range of opportunities and risks. If you're looking to stay ahead in this dynamic market, keeping an eye on the live bond market chart is essential. In this article, we'll delve into the latest trends, key metrics, and insights to help you make informed decisions.

Understanding the Live Bond Market Chart

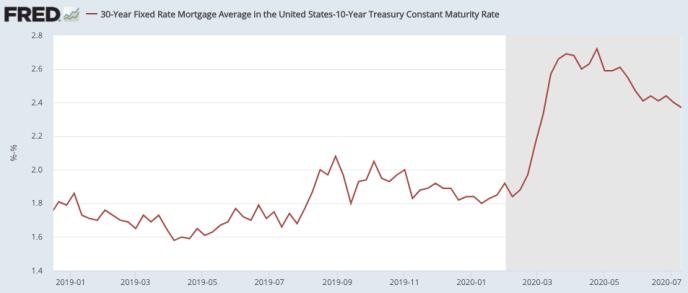

The live bond market chart provides a real-time snapshot of the bond market's performance. It displays various metrics, including bond prices, yields, and interest rates. By analyzing this chart, investors can gain valuable insights into market trends and potential investment opportunities.

Key Metrics to Watch

When examining the live bond market chart, there are several key metrics you should pay attention to:

- Bond Prices: This represents the current market value of a bond. It fluctuates based on various factors, including interest rates, credit risk, and market demand.

- Yields: The yield of a bond is the return an investor can expect to receive based on the bond's price and interest payments. Higher yields often indicate higher risk.

- Interest Rates: Changes in interest rates can significantly impact bond prices and yields. When interest rates rise, bond prices typically fall, and vice versa.

Latest Trends in the Bond Market

As of today, the bond market is experiencing several notable trends:

- Rising Interest Rates: The Federal Reserve has been gradually increasing interest rates, which has put downward pressure on bond prices.

- Corporate Bond Issuance: Corporate bond issuance has been on the rise, providing investors with a wider range of investment options.

- Government Bond Yields: Government bond yields have been fluctuating, with some yields reaching multi-year highs.

Case Study: Analyzing a Live Bond Market Chart

Let's consider a hypothetical scenario involving a 10-year Treasury bond. The live bond market chart shows that the bond's price has fallen from

Strategies for Bond Market Investors

To navigate the current bond market landscape, investors should consider the following strategies:

- Diversification: Diversifying your bond portfolio can help mitigate risk and maximize returns.

- Understanding Credit Risk: Pay close attention to the credit risk associated with each bond, as it can significantly impact your investment.

- Monitoring Economic Indicators: Keeping an eye on economic indicators, such as inflation and GDP growth, can help you make informed decisions about your bond investments.

In conclusion, the live bond market chart is a valuable tool for investors looking to stay informed about market trends and make informed decisions. By understanding key metrics and staying abreast of the latest trends, you can navigate the bond market with confidence and potentially achieve your investment goals.