The U.S. stock market has long been a beacon for investors around the world, drawing significant capital for decades. But just how much money is actually invested in this dynamic market? This article delves into the current state of investment in the U.S. stock market, providing insights into the trends and figures that shape this financial landscape.

Understanding the Scale of Investment

The U.S. stock market is vast, with trillions of dollars in investments. According to data from the Investment Company Institute (ICI), the total amount of money invested in U.S. stock mutual funds and exchange-traded funds (ETFs) as of the first quarter of 2023 reached an impressive $23.3 trillion. This figure includes both domestic and international investments, showcasing the global reach of the U.S. stock market.

Historical Trends and Current Status

Historically, the U.S. stock market has seen significant growth in investments. For instance, in 1999, the total value of U.S. stocks stood at around $9.2 trillion. Fast forward to 2023, and this figure has soared more than twofold. This dramatic increase can be attributed to several factors, including a strong economic outlook, technological advancements, and an influx of retail investors.

Retail Investors and the Rise of the "Retail Revolution"

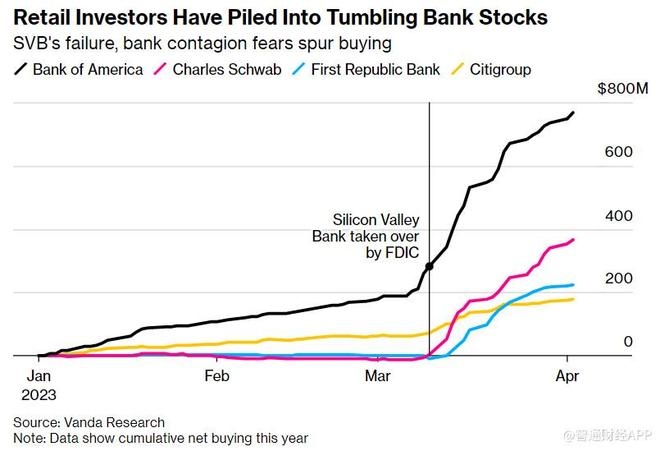

One of the most notable developments in the U.S. stock market has been the rise of retail investors. Platforms like Robinhood have made it easier than ever for individual investors to enter the market. As a result, retail investment in the U.S. stock market has surged, contributing to the overall increase in investment.

Sector Allocation and Top Holdings

The allocation of investments across different sectors within the U.S. stock market also plays a crucial role in its size and composition. Technology and healthcare have been the top-performing sectors in recent years, with a significant portion of investments flowing into these areas. For instance, tech giants like Apple, Microsoft, and Amazon are among the top holdings in U.S. stock ETFs.

Impact of Economic Factors

Economic factors, such as interest rates and inflation, also influence the amount of money invested in the U.S. stock market. In periods of low interest rates, investors often seek higher returns in the stock market, leading to increased investment. Conversely, during times of high inflation, investors may become more cautious, leading to a decrease in investment.

Case Study: The Dot-com Bubble of 2000

A notable case study in the U.S. stock market is the dot-com bubble of 2000. During this period, the market experienced a rapid and excessive growth in the valuations of technology stocks, driven by speculative investing. The bubble eventually burst, leading to a significant decline in the stock market. This event serves as a reminder of the importance of careful investment analysis and risk management.

Conclusion

The U.S. stock market is a behemoth of investment, with trillions of dollars at play. Understanding the factors that drive investment and the sectors that are currently in favor is crucial for investors looking to navigate this complex market. As the landscape continues to evolve, one thing is certain: the U.S. stock market remains a vital component of the global financial system.