The stock market has seen its fair share of turmoil over the years, with investors often left questioning what the future holds. In a fascinating article titled "https://seekingalpha.com/article/4143743-history-tell-us-stock-markets-dive," we delve into the historical patterns that could potentially signal future market dives. By analyzing past market crashes and their causes, we can better understand the factors that may lead to another downturn.

Understanding Market Cycles

To start, it's important to recognize that the stock market is cyclical in nature. Market cycles are characterized by phases of growth, consolidation, and decline. While no one can predict the exact timing of a market dive, historical data suggests certain patterns that can provide clues.

The Dot-Com Bubble

One of the most notable market crashes occurred during the Dot-Com Bubble of the late 1990s. This period saw a rapid increase in the valuation of internet stocks, with many investors buying shares of companies that had little to no revenue. As the bubble eventually burst, many investors lost significant amounts of money. This crash serves as a powerful reminder of the importance of risk assessment and the potential for overvaluation in certain sectors.

The 2008 Financial Crisis

The 2008 Financial Crisis is another prime example of how history can inform our understanding of future market dives. This crisis was primarily caused by the housing market collapse and excessive risk-taking by financial institutions. The crisis resulted in a massive deleveraging of the global financial system, leading to a significant decline in stock prices.

Historical Indicators of Market Dives

So, what can history tell us about potential market dives? Several historical indicators can help us gauge the likelihood of a downturn:

- Valuation Levels: High stock market valuations can be a red flag for future market dives. When stocks are trading at prices that seem disconnected from their fundamental value, it can be a sign of overexuberance in the market.

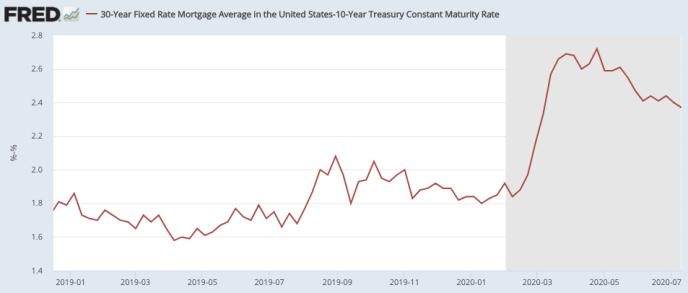

- Interest Rates: Changes in interest rates can significantly impact the stock market. Lower interest rates tend to boost stock prices, while higher rates can have the opposite effect.

- Economic Indicators: Economic data such as unemployment rates, GDP growth, and inflation can all provide insight into the health of the economy and, by extension, the stock market.

Case Studies: Past Market Dives

Let's take a closer look at two case studies that highlight the predictive power of historical patterns:

- 1997 Asian Financial Crisis: This crisis was triggered by a currency devaluation in Thailand, leading to widespread panic in the Asian financial markets. The crisis eventually spread to other regions, resulting in a significant decline in stock prices.

- 2011 Eurozone Debt Crisis: This crisis was caused by the sovereign debt problems of several European countries, particularly Greece. The uncertainty surrounding the crisis led to a drastic drop in stock prices across the globe.

Conclusion

In conclusion, history can provide valuable insights into the factors that lead to stock market dives. By analyzing past market crashes and their causes, investors can better prepare themselves for potential future downturns. While no one can predict the future with certainty, being aware of historical patterns and indicators can help investors make more informed decisions.

Remember, the key to successful investing is to remain vigilant and stay informed about the market's ever-changing dynamics.