The term structure of interest rates plays a pivotal role in shaping the landscape of the US stock market. This article delves into the significance of term structure changes and their impact on the performance of US stocks. By understanding these dynamics, investors can make informed decisions to capitalize on potential opportunities and mitigate risks.

Understanding Term Structure of Interest Rates

The term structure of interest rates represents the yields on bonds with different maturities. It reflects the market's expectations about future interest rate movements. The most commonly referenced term structure is the yield curve, which plots the yields of bonds with maturities ranging from 1 to 30 years.

There are three primary shapes of the yield curve: normal, flat, and inverted. A normal yield curve indicates an upward sloping curve, with shorter-term yields lower than longer-term yields. This shape suggests a strong economy and is often associated with expansionary phases of the business cycle. Conversely, a flat yield curve indicates that short-term and long-term yields are roughly equal, signaling a potential economic slowdown. An inverted yield curve, where short-term yields exceed long-term yields, is often seen as a predictor of a recession.

Term Structure Changes and US Stocks

Term structure changes can have a profound impact on US stocks. Here's how:

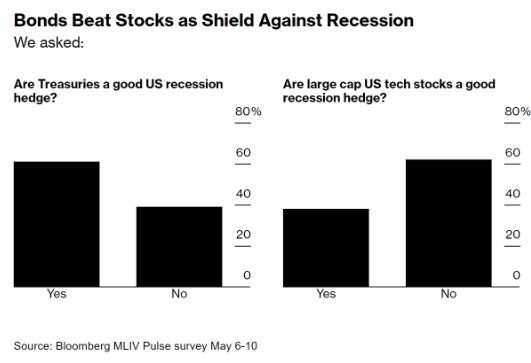

Economic Outlook: Changes in the yield curve often reflect shifts in the economic outlook. A normal yield curve suggests a healthy economy, which is generally favorable for stocks. On the other hand, an inverted yield curve may indicate an impending recession, which can be negative for stocks.

Interest Rate Expectations: The term structure reflects market expectations for future interest rate movements. A rising yield curve suggests that the Federal Reserve (Fed) may increase interest rates, which can be positive for stocks, particularly in sectors sensitive to borrowing costs, such as financials. Conversely, a falling yield curve may indicate lower interest rates, which can benefit sectors like utilities and real estate.

Sector Performance: Different sectors respond differently to term structure changes. For instance, a rising yield curve may benefit financials due to higher interest income, while a falling yield curve may benefit utilities due to their relatively fixed interest payments.

Case Study: 2019 Yield Curve Inversion and US Stocks

In 2019, the yield curve inverted for the first time since 2007, raising concerns about a potential recession. However, US stocks posted strong gains for the year. This suggests that while term structure changes can provide valuable insights, they are just one of many factors that influence stock market performance.

The key to navigating term structure changes lies in understanding the broader economic context and the interplay between various market indicators. By incorporating this knowledge into their investment strategies, investors can make more informed decisions.

In conclusion, term structure changes are an essential aspect of the US stock market landscape. Understanding their implications can help investors identify potential opportunities and risks. As always, it's crucial to conduct thorough research and consider a wide range of factors when making investment decisions.