In today's dynamic financial landscape, the S&P 500 is a cornerstone for investors and market enthusiasts alike. This index, which tracks the performance of 500 large companies across various sectors, serves as a vital indicator of the broader U.S. stock market's health. In this article, we delve into the current value of the S&P 500, its recent trends, and what it signifies for investors.

Understanding the S&P 500

The S&P 500, also known as the Standard & Poor's 500, is a market index that captures the performance of 500 large companies across various sectors of the U.S. economy. It is considered one of the most influential benchmarks for the U.S. stock market and is often used as a proxy for the overall market's performance.

Current Value of the S&P 500

As of the latest data, the S&P 500 is valued at approximately 4,200 points. This figure represents a blend of the market capitalization of the 500 constituent companies. The index has experienced fluctuations over time, influenced by economic conditions, corporate earnings, and investor sentiment.

Recent Trends in the S&P 500

In recent years, the S&P 500 has shown remarkable resilience. Despite facing various challenges, including the COVID-19 pandemic and geopolitical tensions, the index has managed to recover and reach new highs. This resilience is attributed to several factors:

- Economic Growth: The U.S. economy has shown signs of recovery, driven by strong consumer spending and business investment.

- Corporate Earnings: Many S&P 500 companies have reported strong earnings, contributing to the overall growth of the index.

- Investor Sentiment: Optimism among investors has played a significant role in supporting the S&P 500's value.

What the S&P 500 Value Today Indicates

The current value of the S&P 500 provides several insights into the market's current state:

- Market Confidence: A high S&P 500 value suggests that investors have confidence in the U.S. stock market's future prospects.

- Economic Health: The index's performance reflects the overall health of the U.S. economy, as it includes companies from various sectors.

- Investment Opportunities: The S&P 500 offers a diverse range of investment opportunities, as it covers a broad spectrum of industries.

Case Studies

To illustrate the impact of the S&P 500 value, let's consider two case studies:

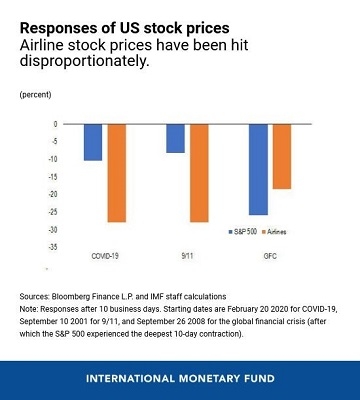

- During the COVID-19 Pandemic: The S&P 500 experienced a sharp decline in March 2020, as the pandemic led to widespread economic uncertainty. However, the index quickly recovered and reached new highs by the end of the year, demonstrating its resilience.

- Post-Election Sentiment: Following the 2020 U.S. presidential election, the S&P 500 experienced a brief period of volatility before stabilizing and continuing its upward trend. This indicates that investor sentiment can have a significant impact on the index's value.

Conclusion

The S&P 500 value today is a critical indicator of the U.S. stock market's health and future prospects. As investors and market enthusiasts, it's essential to stay informed about the index's performance and its underlying factors. By understanding the S&P 500, we can make more informed investment decisions and navigate the dynamic financial landscape with confidence.