In the vast landscape of the US stock market, understanding which companies are not just profitable but also efficient in generating returns on equity (ROE) is crucial for investors. ROE is a key financial metric that indicates how effectively a company is using its shareholders' equity to generate profit. This article delves into the ROE ranking of US stocks, highlighting top performers and offering valuable insights for investors.

Understanding ROE

Before we dive into the rankings, it's essential to understand what ROE represents. ROE is calculated by dividing a company's net income by its shareholders' equity. The formula is as follows:

[ \text{ROE} = \frac{\text{Net Income}}{\text{Shareholders' Equity}} ]

A higher ROE suggests that a company is generating more profit with the money invested by its shareholders. This makes ROE a critical indicator of a company's financial health and profitability.

Top ROE Performers in the US

Several US companies have consistently demonstrated strong ROE performance. Here are some of the top performers:

Apple Inc. (AAPL): As the world's largest technology company, Apple has an impressive ROE of 28.8%. Its robust product lineup and global presence have contributed to its profitability.

Microsoft Corporation (MSFT): Microsoft, known for its software and cloud services, boasts an ROE of 31.6%. The company's diversified revenue streams and innovative products have driven its financial success.

Procter & Gamble Co. (PG): This consumer goods giant has an ROE of 24.2%. P&G's strong brand portfolio and global distribution network have helped it generate significant returns for shareholders.

Johnson & Johnson (JNJ): With an ROE of 29.2%, Johnson & Johnson is a leader in the healthcare industry. The company's diverse product range and commitment to innovation have contributed to its strong ROE performance.

Visa Inc. (V): As a global payments technology company, Visa has an ROE of 28.6%. Its market dominance and strong financial performance have made it a top ROE performer.

Insights for Investors

Investors should consider several factors when analyzing a company's ROE:

Consistency: Look for companies with a consistent ROE over several years. This indicates that the company has a sustainable business model and can generate profits consistently.

Growth: Consider companies with a growing ROE. This suggests that the company is improving its profitability over time.

Sector: Different sectors have varying ROE expectations. For example, technology companies often have higher ROEs compared to utilities or telecommunications companies.

Debt: Companies with high levels of debt may have lower ROEs. It's important to assess a company's debt levels to understand its financial health.

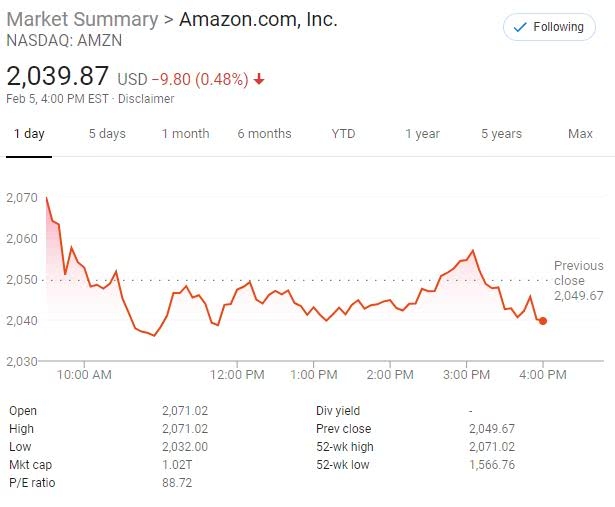

Case Study: Amazon.com, Inc. (AMZN)

Amazon, the world's largest online retailer, has an ROE of 16.4%. While this may seem lower compared to the companies mentioned earlier, it's important to consider Amazon's growth trajectory. Amazon has reinvested its profits into expanding its operations and diversifying its product offerings. This strategic approach has helped Amazon become a market leader and generate significant returns for shareholders.

In conclusion, analyzing the ROE ranking of US stocks can provide valuable insights for investors. By focusing on companies with strong ROE performance, investors can identify potential opportunities for investment. However, it's crucial to consider various factors, including consistency, growth, sector, and debt levels, when making investment decisions.