Are you looking to invest in U.S.-focused stocks? Fidelity Investments offers a range of investment options that cater to various investor profiles. In this article, we delve into a Morningstar analysis of Fidelity’s U.S. focused stock funds, exploring their performance, risk, and potential returns.

Understanding Fidelity U.S. Focused Stock

Fidelity U.S. Focused Stock is a mutual fund that primarily invests in U.S.-based companies. This fund aims to provide investors with exposure to a diverse portfolio of stocks, offering the potential for growth and income. The fund’s investment strategy focuses on companies with strong fundamentals and a proven track record of performance.

Performance Overview

According to a recent Morningstar analysis, Fidelity U.S. Focused Stock has demonstrated a consistent performance over the years. The fund has outperformed its benchmark index in many instances, showcasing the effectiveness of its investment strategy. This impressive performance can be attributed to the fund’s focus on high-quality companies with strong growth prospects.

Risk Assessment

While the fund has shown impressive performance, it’s important to note that investing in stocks always comes with risks. The Morningstar analysis highlights that Fidelity U.S. Focused Stock has a moderate level of risk, which is consistent with its focus on U.S. equities. Investors should be prepared for market volatility and potential fluctuations in the fund’s value.

Fund Composition

The fund’s portfolio is well-diversified, with investments in various sectors, including technology, healthcare, financials, and consumer discretionary. This diversification helps reduce the fund’s risk exposure, making it suitable for a broad range of investors.

Top Holdings

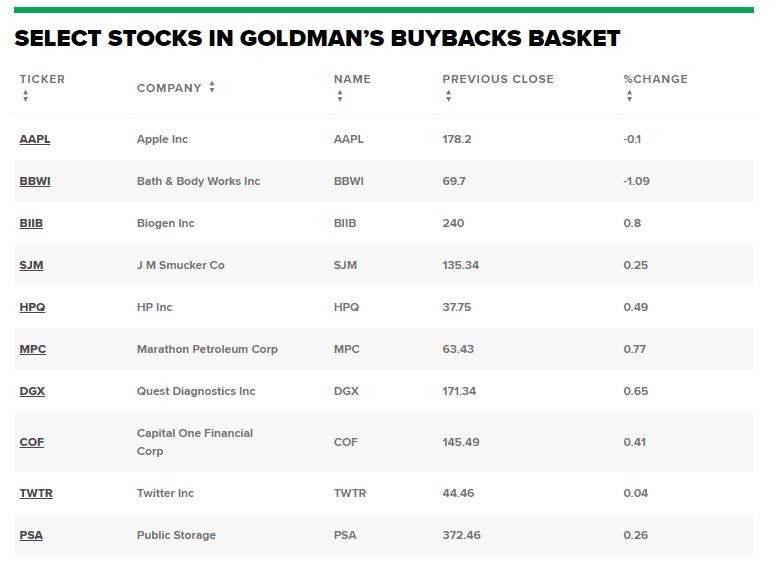

A Morningstar analysis of the fund’s top holdings reveals a focus on well-known companies with strong market positions. Some of the top holdings include Apple Inc., Microsoft Corporation, and Amazon.com, Inc., among others. These companies are known for their robust fundamentals and growth potential, making them ideal investments for the fund.

Case Study: Apple Inc.

One of the fund’s top holdings, Apple Inc., is a prime example of a high-quality company that has delivered impressive returns. Over the years, Apple has successfully diversified its product lineup and expanded into new markets, leading to strong financial performance. The Morningstar analysis indicates that Apple’s inclusion in the fund’s portfolio has significantly contributed to its overall performance.

Conclusion

Fidelity U.S. Focused Stock is a compelling investment option for those looking to invest in U.S.-based stocks. With a strong performance track record, moderate risk profile, and a well-diversified portfolio, the fund offers investors a solid opportunity for growth and income. However, it’s essential to conduct thorough research and consider your investment goals and risk tolerance before investing in any mutual fund.